News:

Accelerate your digital agenda

Posted on 03rd March 2024

Accelerate your digital agenda

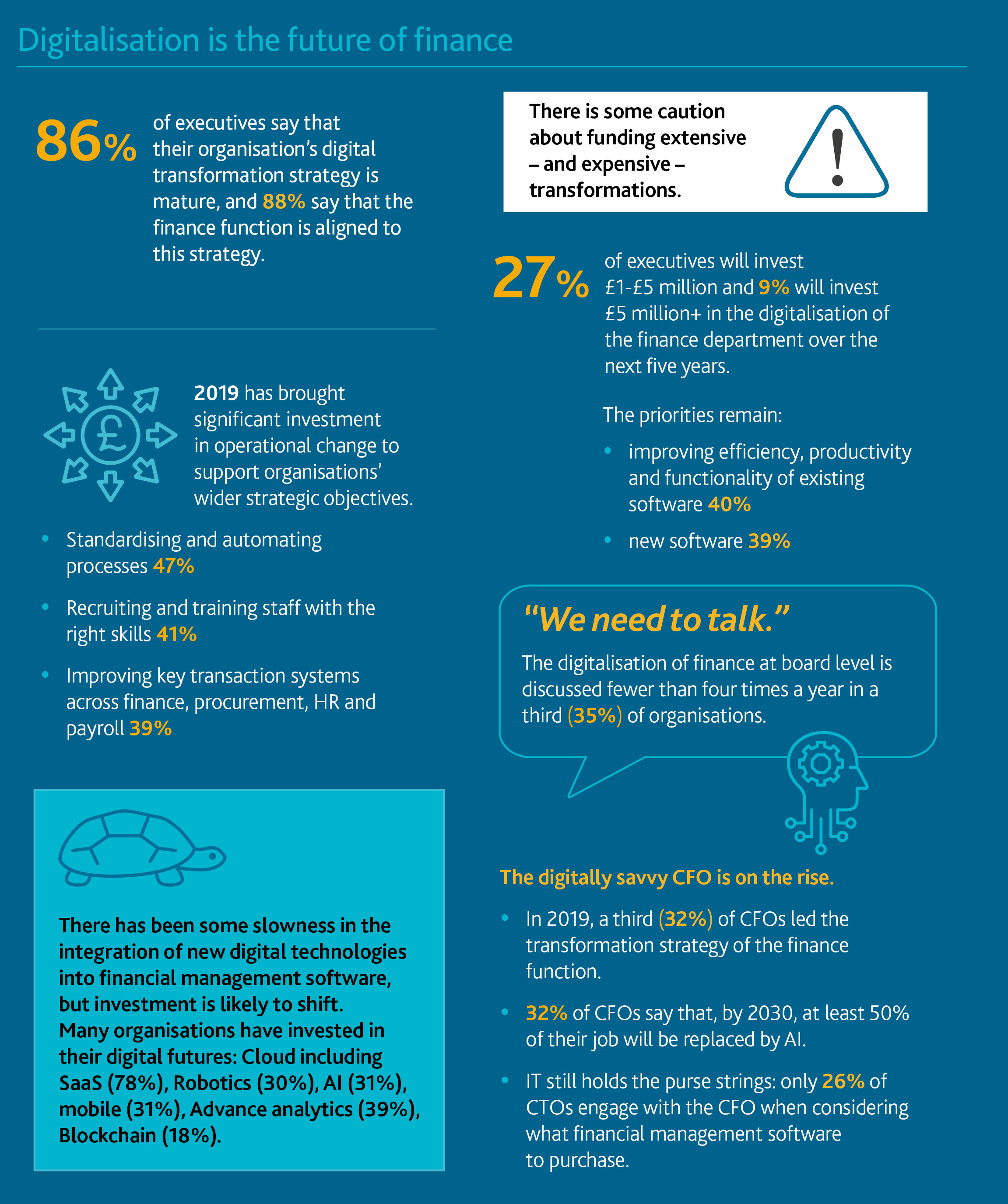

HMRC has stated that it wants to become ‘one of the most digitally advanced tax administrations in the world’. Stringent new regulation has made fundamental changes to the ways organisations buy, sell, invoice and account for their financial activities. From Making Tax Digital to e-invoicing, PEPPOL (Pan European Public Procurement online), and e-procurement – it’s all about going digital.

It’s a fact that new UK and European legislative changes are challenging public and private organisations to adopt a digital mindset and accelerate their digital transformation strategies.

What’s also true is that legislation is likely to increase rather than decrease over the next few years. This means that staying compliant is going to become a continuous and ongoing challenge for all organisations. Businesses will need to build flexibility and agility into their ways of working so they can respond rapidly to any new changes – ensuring they follow new complex regulatory rules whilst still focusing on winning new business and achieving strategic outcomes.

Most finance teams have already digitised at least some of their financial management systems to automate business rules and remain compliant, but many still operate a range of disjointed, in-house, niche 3rd party or spread sheet systems which are costly to run and tricky to alter. Having to make constant changes to keep up with new regulations across disparate, poorly connected systems will undoubtedly impact performance, profit and growth as well as hindering competitiveness with today’s nimble digital-born industry players.

Taking the digital leap

So, what’s stopping organisations from taking the full digital leap? Many fear it will be disruptive, prohibitively expensive and time consuming - challenging already stretched management time, resources and budgets. For others – embracing new cloud technologies and using web-based software is profoundly worrying and they are unsure about where, how and when to securely move ‘to the cloud’. What’s more, many are concerned that becoming the agile, mobile and data hngry team needed to maximise the opportunities offered by digital transformation will require major resource changes, impacting jobs and staff morale

The good news is that implementing a new digital financial management software solution doesn’t have to be difficult or disruptive.

- Firstly, successful digital transformation is about taking a series of small steps to digitally advance rather than one giant leap

- Secondly, most leading providers understand that people are at the centre of change and are adept at introducing new and different ways of working across people, processes and technology – so they make the change to digital as easy, enjoyable and straightforward as possible

- Thirdly, software providers have a wealth of experience at successfully migrating complex systems for numerous organisations and know how to embed a dynamic digital culture across the business operation, on time – first time

- Lastly, it doesn’t have to be time consuming or take up a lot of resources. Powerful yet highly flexible financial management software modular systems can be quickly created to meet individual requirements – seamlessly integrating with most third party and/or existing systems to deliver frictionless financial management.

Embrace new technologies and power up your digital agenda

Below are a few digital tips Capita Integrated Business Solutions recommends that all finance teams embrace within the next 12-24 months to accelerate their digital journey and help keep up with new regulations to achieve their business goals.

Embrace Automation: new advanced solutions reduce administration costs by automating and streamlining standard processes whilst increasing accuracy and boosting performance

Think Cloud: New cloud-based financial management systems offer high-level security with in-built flexibility, empowering finance operations to scale (or down) quickly and efficiently. They also provide a first-class management service, freeing up local IT teams to focus on core business tasks

Go Mobile: New mobile approval functionality with advanced workflows let organisations speed up invoicing and procurement functions so managers can approve ‘on the go’ including all ‘Purchase-to Pay’ e- invoicing and procurement activity. What’s more, by embracing new mobile technologies you’ll be enhancing communication and encouraging better relationships with vendors (as well as between internal teams) as invoices are accepted, approved and paid more promptly.

Share knowledge and data: More digital data means increasingly detailed information is collected across all areas. Access to accurate and transparent company-wide information means managers can see, analyse and report on what’s happening across the business in real time to make better, faster decisions that increase competitive edge.

To find out more about how Capita IB Soultions can support you in accelerating your digital agenda, use the Contact Us form and we will be in touch to discuss the next steps in your digital journey.

Share this page: